Enabled by advances in technology, the automotive industry has entered into an unprecedented era of disruption and transformation. The industry is changing at a faster rate today than at any time in the past 100 years. While previous waves of innovation were largely focused on design and manufacturing, making cars mass-producible, more affordable, faster, safer, and more reliable, innovation largely came from within the industry and therefore allowed the industry to remain more-or-less unchanged for most of the last century. The current wave of disruption, on the other hand is enabled predominantly by electronics and software, with much of the most dramatic innovation coming from industry newcomers or even from complete outsiders. In response to changing demographics and consumer preferences, technology is having a profound impact on every aspect of the automotive and transportation ecosystem and supply chain, revolutionizing existing business models and creating entirely new markets along the way, changing how we buy, sell, share, service, drive, fuel, design, and manufacture our vehicles, creating new and disruptive business models along the way.

Historically, carmakers held tight reign over the innovation process. Whether through vertically integrated component manufacturers or closely coupled external suppliers, development projects happened when and how the carmakers dictated. Before a component could start into production as part of a vehicle platform, it would undergo rigorous qualification testing, adding 18 to 24 months to the product-development cycle on top of normal consumer R&D times. Critics of the traditional automotive innovation process argue that these design cycles and times-to-market have been notoriously long, while advocates point out that this way of working ensures robustness and reliability far beyond anything seen in the consumer, mobile, or computing industries. While both arguments are correct, there can be no denying that this closely controlled approach to R&D has left the automotive industry lagging in its ability to successfully leverage emerging technologies in response to shifting consumer demographics and potentially disruptive new business models.

When Societal Mega Trends and Technology Trends Converge

At the same time that affordable computing power and smart phones have become pervasive, and that advances in connectivity, security, and machine intelligence have enabled the Internet-of-Things, consumers have started to rethink their assumptions around personal transportation in response to climate change, shifting demographics and changing attitudes about ownership of assets vis-à-vis the “sharing economy.” Millennials in particular have become an increasingly important economic demographic. As a group, they are generally very tech savvy, but they seem to be less interested than prior generations in ownership of high value assets such as cars. At the same time, there is an ongoing trend towards urbanization. Over 85% of the developed world’s population will be living in urban areas by 2050[1]. The combined ramifications of these technological and socio-demographic changes are profound and potentially very disruptive for the automotive industry, especially in urban environments, where traffic and parking costs can be problematic. For many people, but especially the millennial generation, getting from point A to point B conveniently and affordably is much more important than owning the means of transportation. But disruptions also create tremendous opportunities for those companies inside, or entering, the automotive ecosystem that are best able to leverage innovation to capitalize on these mega trends.

There are three main areas in which these societal and technology megatrends are converging in automotive:

- The transition away from fossil fuels towards New Energy sources, which primarily means the electrification of the drivetrain in hybrid and electric vehicles (H/EVs).

- Dramatic improvements in Connectivity technology, both inside the car and between the car and the outside world, enabling previously disparate systems within the car to operate in coordination and, more profoundly, enabling the car to become part of the broader Internet of Things

- The development of Advanced Driver Assistance Systems (ADAS) based on computer-based perception of the environment, which improves safety by avoiding collisions rather than merely mitigating their impact, and which ultimately will enable cars to become fully Autonomous and self-driving.

Taken together these trends will make cars safer and less harmful to the environment, improve traffic flow in densely populated areas, and create new modes of personal, public, and commercial transportation based on new and disruptive business models (companies like Uber and Lyft are just the tip of the business model disruption iceberg).

Some analysts describe a fourth innovation trend: Security. There is no question that security will be a key area for innovation in the automotive industry going forward. However, the need for security is essentially being created by the strong emergence of connectivity and the evolution from ADAS towards autonomous vehicles, and therefore I do not consider it a separate trend, but rather a key enabler of the three primary trends.

As carmakers compete to out innovate each other in their bids to win the time-to-market race in connected, autonomous, and electric vehicles, they have been looking for solutions outside their traditional R&D organizations and supply chains. They turn to other industries, such as the mobile, consumer electronics, and computing industries, which have shorter product lifecycles, for new ideas and new methodologies, including advanced computing and artificial intelligence. These new approaches to solving automotive technology problems require new semiconductor devices, which may not yet be available from the traditional automotive semiconductor suppliers. As a consequence, the Automotive Semiconductor Industry is also undergoing significant disruption and transformation, which can roughly be categorized into three main areas:

- Consolidation through Mergers & Acquisitions.

- Entrance of chip vendors from other market segments like mobile or computing.

- The emergence of entirely new start-up companies that are better able to address specific market and technology niches left open by the established semiconductor players.

Mergers & Acquisitions

Mergers and acquisitions are nothing new to the semiconductor industry. The capital investment and R&D required to develop and maintain leading edge process, design and manufacturing technology, and to a lesser extent, cost of sales, can be extremely high for semiconductor companies, especially foundries and integrated device manufacturers (IDMs). Scale and volume are significant profit drivers in the industry. However, in the past few years, there has been a surge of M&A activity motivated, at least in part, by the desire to strengthen market position in the increasingly attractive automotive semiconductor market. Ninety percent of innovation in the automotive industry comes from electronics and software[2], driven by the three main technology trends of H/EVs, Connectivity, and ADAS/Autonomous, which in turn fuels tremendous demand for automotive integrated circuits (ICs). As a result, the automotive semiconductor market is expected to be one of the fastest growing segments of the semiconductor industry in the foreseeable future[3]. Furthermore, automotive is recognized as being significantly less cyclical than the mobile, computing, or consumer spaces, with higher barriers to entry due to automotive industry quality requirements, and the customer commitments tend to be much “stickier” due to longer product lifecycles and high switching costs once a customer has developed and qualified an application around a specific semiconductor solution. All of these factors combine to make automotive semiconductors a very attractive segment of the market. Consequently, semiconductor players have been using M&A as a means to gain competitive advantage, either by enhancing their portfolio or simply by acquiring market share in the space. Two examples of M&As from 2015 which were significantly motivated by the automotive growth trends were NXP’s acquisition of Freescale, creating the largest automotive semiconductor company in the world, and Infineon’s takeover of IR, which further strengthened Infineon’s leadership in automotive power ICs. As of this writing, Qualcomm is currently in the process of finalizing regulatory approval for their buyout of NXP, no doubt motivated in part by concerns over the growth prospects in Qualcomm’s core markets and by their clear aspirations to accelerate growth in Automotive.

New Entrants

As automakers and their suppliers seek out new technological innovations from other markets, it is natural that they will want to work with the leaders in those markets. Quite often, however, those leaders are not the same players who have been supplying mainstream automotive solutions. Ten or fifteen years ago, the leaders in ICs for mobile phone, digital consumer, or PCs and Networking were not overly enthusiastic to engage with the automotive industry, given the slower time-to-money, the more stringent quality requirements, and the lower volumes. However, now that the automotive semiconductor market has become attractive relative to these other segments, many of these leaders are now actively seeking to sell their solutions to automotive customers. This convergence of supply and demand for new solutions has opened up the automotive supply chain to such notable “new entrants” as Intel, Nvidia, and Qualcomm, established leaders in other domains that have begun making significant automotive-targeted investments in marketing and R&D, and in some cases, even M&As. As a result, these companies have gained significant traction in emerging areas of the automotive market such as the connected car, graphics head-units, and autonomous driving.

Startups

Traditionally, the automotive industry has not been “friendly” to startup companies, especially hardware startups, due to the inherent conservatism of the industry, which has preferred to work with established suppliers. This conservatism has very practical roots: stringent quality and supply reliability requirements. Suppliers into the automotive industry are also expected to have sufficient capital reserves to protect and defend the supply chain in the event of liabilities that may result from quality or delivery problems. These barriers to entry are particularly challenging for cash-strapped startup companies. Furthermore, the broader semiconductor industry itself was becoming unfavorable to startup companies, undergoing a downturn in venture funding which bottomed out in 2012 and 2013 before rebounding somewhat in the last few years[4]. Startup semiconductor companies hoping to enter the automotive market found themselves at the intersection of these two harsh and mutually reinforcing realities: with the doors to the market all but locked tight, the companies had a difficult time attracting venture capital. Without capital, the market became all the more impenetrable.

In nature, even the harshest of environments is rarely devoid of life. And once life begins to take hold, an ecosystem develops. Disruptions to that ecosystem sometimes create opportunities for new species to evolve or for an invasive species to get a foothold and thrive. While not a perfect analogy, this is one way of thinking about what has been happening in the automotive semiconductor industry. The same disruptions to the industry that are triggering M&As and attracting new entrants are also creating opportunities for startups to gain a foothold. This is not to say that the automotive market has suddenly become an easy environment for startup semiconductor companies. Competition amongst the large and growing established players as well as the new entrants is fierce. Quality requirements remain stringent and challenging for fledgling companies with limited financial resources. No, it is just that the appetite at car OEMs and tier-1 suppliers for new innovative solutions has become so great that they are willing to consider working with startups when they offer something truly unique and differentiating that cannot be obtained through their more traditional channels. Geo Semiconductors, AutoTalks, and TriLumina are a few of the startup semiconductor companies to gain traction in the automotive industry in the last few years. Possibly the most famous automotive semiconductor startup, though, was Mobileye, the Israeli fabless semiconductor company that gained a dominant position in the vision processing market for ADAS and the nascent autonomous driving market. However, their path to success was anything but meteoric, having taken nearly 10 years from inception to establishing themselves as the leader in their market. Their success ultimately attracted the attention of Intel, who acquired Mobile for $15.3B as part of its own bid to strengthen its entry into the automotive market.

Coping with Disruption: Resistance versus Resilience

Coping with Disruption: Resistance versus Resilience

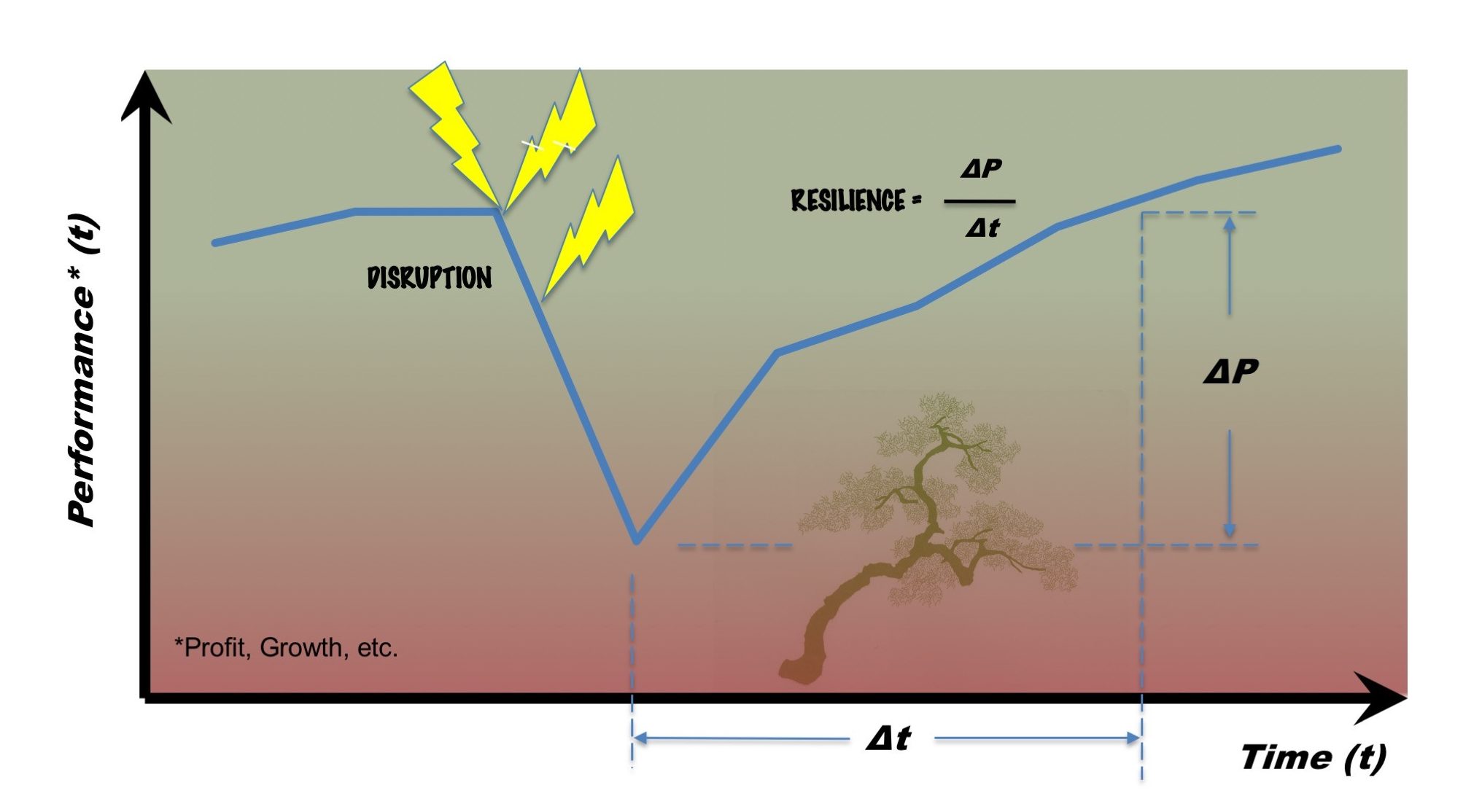

Success breads complacency. Business journals are filled with cautionary tales of companies that lost their established leadership positions either because they failed to recognize a significant disruption on the horizon or because they steadfastly resisted the implications of that disruption until it was too late. “We’ve always done things this way, why change now?” or “Our customers don’t want that. It’s just a passing fad!” have been proverbial battle cries of the walking dead for decades. Think about companies like Motorola or Nokia in the mobile phone space, Sears in retail, or Eastman Kodak in photography to name just a few of the famous leaders who completely missed major technological changes in their industry. Whether by stubborn intention or inability to execute, these companies stood firmly rooted to their traditions, like rigid oak trees attempting to resist hurricane force disruptions, ultimately suffering severe damage.

The billion-dollar question for the legacy automotive industry, including the Tier-2 automotive semiconductor suppliers, is whether these companies will behave like the mighty oak, stiffly resisting the forces of disruption—or if they will emulate the cypress, flexing and bending just enough to hold their ground, surviving storms and fires, all the while continuing to grow, possibly even stronger and more resilient than ever. It can be argued that resiliency will come more naturally to the automotive semiconductor suppliers than it will to their customers further up the value chain. Chip vendors, for the most part, are younger companies accustomed to operating in a high-growth yet highly cyclical industry prone to periodic disruption, compared to the more traditional automotive companies operating in a slower growth market, which had remained largely unchanged for most of the last century. The confluence of the three main technologically enabled megatrends, New Energy, Connectivity, and Autonomous Driving, has brought these two contradictory business realities crashing together. The most competitive Automotive Semiconductor suppliers going forward will be those companies who have mastered both realities simultaneously. On the one hand they will be nimble innovators. They must either be the disruptors or be extremely fast followers with other significant competitive advantages. At the same time, they must be experts in operating according to the established rules of a still very traditional industry. They must have their own supply chain firmly under control in order to ensure they are able to meet their customers’ delivery and quality requirements. Their hardware and software designs must have undergone stringent verification and validation before release to manufacturing and the products must have gone through extensive time-consuming qualification. Companies that master the innovation but not the quality side of the equation risk finding themselves engaged in various Proof of Concept (POC) programs with the automotive industry only to lose out to more trusted suppliers when those programs ramp into volume production. Companies that fall behind on the innovation curve risk missing entire market cycles, no matter how good their quality might be. The biggest winners in the Automotive Semiconductor industry will be those companies with strong established roots in automotive, the ability to disrupt through innovation, and the resilience to adapt and thrive in the face of external disruptions.

Notes

[1] “Urban life: Open-air computers”. The Economist. 27 October 2012.

[2] “Innovation in the car: 90% comes from electronics and software”. Christoph Hammerschmidt, eeNews Europe. 29 April 2014.

[3] “Research Bulletin”. IC Insights. 29 November 2016.

[4] “The Revival Of Semiconductor Funding”. Ilgiz Akhmetshin, Tech Crunch. 29 August 2014.

About the Author

CEO of the Association for Corporate Growth, Silicon Valley (ACGSV), Drue Freeman is a 30-year semiconductor veteran, with 17 years focused on automotive. He advises and consults for technology companies from early-stage startups to multi-billion-dollar corporations and for financial institutions investigating the implications of the technological disruptions impacting the automotive industry. Mr. Freeman is on the Advisory Boards of several privately held companies in the automotive and transportation space. Previously, Mr. Freeman was Sr. Vice President of Global Automotive Sales & Marketing for NXP Semiconductors, he launched and served on the Board of Directors for Datang-NXP Semiconductors, the first Chinese automotive semiconductor company, and spent four years as VP of Automotive Quality at NXP in Germany. He is an Advisory Board Member of BWG Strategy LLC, an invite-only network for senior executives across technology, media and telecom, and on the Board of Directors of Sand Hill Angels, a group of successful Silicon Valley executives and accredited investors who are passionate about entrepreneurialism and the commercialization of disruptive technologies.

CEO of the Association for Corporate Growth, Silicon Valley (ACGSV), Drue Freeman is a 30-year semiconductor veteran, with 17 years focused on automotive. He advises and consults for technology companies from early-stage startups to multi-billion-dollar corporations and for financial institutions investigating the implications of the technological disruptions impacting the automotive industry. Mr. Freeman is on the Advisory Boards of several privately held companies in the automotive and transportation space. Previously, Mr. Freeman was Sr. Vice President of Global Automotive Sales & Marketing for NXP Semiconductors, he launched and served on the Board of Directors for Datang-NXP Semiconductors, the first Chinese automotive semiconductor company, and spent four years as VP of Automotive Quality at NXP in Germany. He is an Advisory Board Member of BWG Strategy LLC, an invite-only network for senior executives across technology, media and telecom, and on the Board of Directors of Sand Hill Angels, a group of successful Silicon Valley executives and accredited investors who are passionate about entrepreneurialism and the commercialization of disruptive technologies.